Q&A with Ametros CEO Porter Leslie

Porter Leslie spent the early part of his career in financial services, working in investment banking, private equity and corporate development before making his way to healthcare. But in both industries, his focus has been on building customer-facing businesses, with the aim of helping clients overcome challenges.

That’s why he was drawn to Ametros, a professional administration company that helps individuals settle their personal injury or workers’ comp cases and manage treatment funds efficiently by capturing discounts where possible and fixing medical billing errors. Essentially, they make an inherently stressful and confusing process simpler and more streamlined, so patients can focus on getting better.

We sat down with Porter to discuss the complexities of the healthcare system, how technology can help make things easier, and why he loves what he does.

Q: How does your background in financial services help you navigate the complexity of healthcare and injury settlements?

PL: There’s a lack of transparency in the way healthcare services and prescriptions are priced and billed. Over 90% of medical bills have mistakes in them. A procedure that should be billed under one code and cost $500 ends up being billed under multiple codes and running closer to $2,000. An invoice for a single visit could have five different line items. For the everyday lay person, it’s hard to cipher, and there’s not a resource where people can go plug in those codes to determine the accuracy of the bill themselves. All of that can be pretty stressful, which doesn’t exactly help your health.

My background in finance helps me know what to look for. But more importantly, we have partners who help us review bills — experts who have spent their entire careers in claims and who can spot things that look irregular.

Q: How has technology enabled Ametros to capitalize on discounts and other cost- saving opportunities for patients?

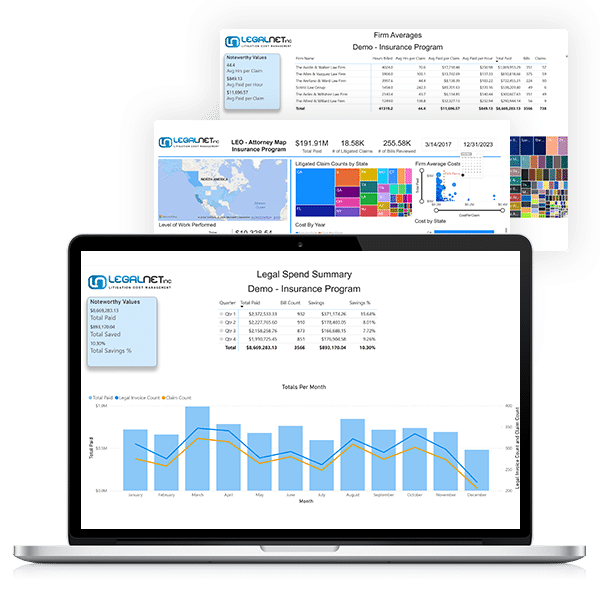

PL: Technology is the centerpiece of how we function at our current scale. We’re processing well north of 100,000 bills and prescriptions per year. To do that, you need a platform that reviews invoices automatically, determines if the patient has enough funds in their account to cover it, and pays the bill automatically. It all has to fit together.

On the human capital side, our employees can use the technology to be smarter and spend their time in more valuable ways. We have 40+ member care representatives on the phone answering questions for patients (who we call our members), for example. To do that effectively, we need a lot of information easily accessible in one place. We’ve been able to harness all that for the injured person. We’re connected to a lot of systems and vendors in real time, so everything happens faster. When a patient visits the doctor, we get the bill faster, which means we can get them paid or correct mistakes faster. All of that makes life easier for the patient.

During the pandemic we started to proactively leverage our technology to increase engagement. We built a chat function for our website, for example, and a text messaging system so we can reach out to members. We took advantage of a time when a lot of people are just sitting at home to be more interactive. In the end, all of that technology helps us be more helpful to our members.

Q: How do you see technology evolving in the healthcare industry to better serve patients?

PL: There’s a lot happening. We recently brought on some doctors and launched a medical advisory council to help us stay on top of the trends. We have to stay up to date on what our members are using, because that’s what we’ll be getting a bill for.

One thing we’re seeing is this explosion of data and ease of accessing information. Take wearables — simple things like watches tracking all kinds of biometric data like heart rate, sleep cycles, blood sugar control, and more. It can all be collected on the central hub of the smartphone and shared directly with a physician in real time for personalized feedback. There are also new tools that help people access and manage their care, like apps that remind patients to take a medication, renew a prescription, or schedule an appointment.

Advancements in electronic medical records (EMR) also make care more streamlined and of better quality. You may take it for granted that your primary care doctor can see information about your visit at another facility; that connectivity means he or she doesn’t have to spend time calling other providers to get a full picture of your health history. It improves efficiency and accuracy, and that leads to better decision-making.

The billing and payment side is always a bit of a battleground, but even there the connectivity of systems has produced cleaner and more accurate bills, which helps us approve things faster for patients.

Q: What challenges has the pandemic introduced for Ametros? Have stay-at-home orders and increased reliance on telehealth changed the way you manage care or administer settlement funds?

PL: Like everyone, our member base was scared. We did see in the first few months a lot less provider treatment, due to people cancelling elective procedures or therapies. And we saw a massive uptick in telehealth usage, which thankfully Medicare said they would start covering much more broadly, which drove even more adoption.

We saw 40 to 50 times the number of telehealth visits per month during the height of the pandemic. Even now it’s hovering around 25% of all visits, where it used to be just a tiny fraction. We also had people asking about mail order prescriptions or DME – another trend that has persisted.

I do think the pandemic forced some good change in the industry. There was this reticence to use telehealth and do things virtually. On the insurance side, the actual legal work to settle the cases had to be done almost entirely in person. A month or two in to the pandemic, there was a clear need to find another way so injured people could get the funds they needed for treatment. By mid-April most states were doing hearings or mediations on Zoom, and that’s continuing now. Some of the changes might be permanent. Why wait to get all the lawyers together and pay for travel costs if you can just knock it out with a call? It does make life easier in a lot of respects.

Q: What changes do you believe would need to happen in the healthcare industry to make the system easier to navigate?

PL: More cost transparency. There have been legislation recently requiring hospitals to list their prices for certain procedures, but it’s just scratching the surface. Also more provider accessibility. It should be easier to find out where you can get a specific treatment and get an appointment. On the billing side, there just needs to be more specificity and consistency in what gets billed. If you know what things cost, where you can go to get it, and that you were going to get billed in a fair way, that’s all about all you can ask for when it comes to navigating healthcare.

Q: What do you find most rewarding and most challenging about your job?

PL: As a growing company, our biggest challenge is communication, and making sure we’re always on the same page with all 150 of our employees and our clients.

That growth is also very rewarding in itself. We are probably four times the size now that we were just three or four years ago. Nobody else was doing what we’re doing at this scale, so we got to create the industry and define what it means to be professional administrator.

The most rewarding part of the job, however, is the people. I work with a team I really respect, and I get a lot of joy from helping people achieve better health.