by Christopher Curl, President & CEO, CEC Group

“Revolutions are won or lost by commitment and dedication to a cause,”

said Marquis de Lafayette, who fought with colonial troops and is a true American Revolution hero. Nearly 234 years later, I suppose he was saying: “Stick with the plan.”

But as times change, plans change.

Case in point: “There was so much going on in the early part of the 21st Century, the insurance industry was in a major state of change,” says a retired industry executive, who preferred to remain unnamed. “And, then came September 11, which distracted us from everything; it was all about getting Congress to back the insurance industry in case of more terror attacks.” That became a priority for 5 years and the resulting Terrorism Risk Insurance Act (TRIA) gave protection to the insurance industry.

Some other notable developments through the rest of the 21st Century to date:

- Litigation spend was rising and so were civil jury verdicts.

- Roughly 94% of personal injury civil trial cases settled before trial.

- Average personal injury settlement of cases in litigation is $53,000. (Forget the home runs; they are rare.)

- Two of the largest awards in this century were against cigarette manufacturers in class action litigation. In fact, product liability — especially against drug manufacturers — continue to drive huge awards.

- California (considered liberal) and Texas (considered conservative) yield the highest jury awards per capita.

There was also a counter-revolution by the defense industry. Much like medical provider costs were being managed for Workers’ Compensation, carriers and TPAs sought to manage legal costs through electronic bill review. In the meantime, defense firms were doing more to strengthen relationships with corporate clients vs. claims providers. Major brands were threatened with high publicity and social media driven exposures. Through special service agreements, claims service providers were forced to accept their client’s legal relationship requirements or risk losing their business.

“We were really behind the 8 Ball” said the retired underwriting executive. “We were writing more large retention business, giving the insured more control financially and for service.”

Increased litigation spends drove higher expense ratios, but ultimately corporate clients were paying much of those costs.

There continued to be focus on legal cost control. Litigation management companies like LegalNet were gaining ground. What made LegalNet different from competitors was a realization that the attorney relationship was paramount.

“There’s a way to control costs without destroying a relationship,” says Dan Burkland, founder of LegalNet. “You can hold firms accountable for legal billing and not destroy the relationship with their clients.”

According to Burkland, the industry could be further along in litigation spend control. “The industry still seems more intent on controlling WC medical spend. Litigation spend is just as significant,” says Burkland. And he’s disappointed that more hasn’t been done to obtain better data. “Litigation Management got kicked back while medical cost control kicked-up.”

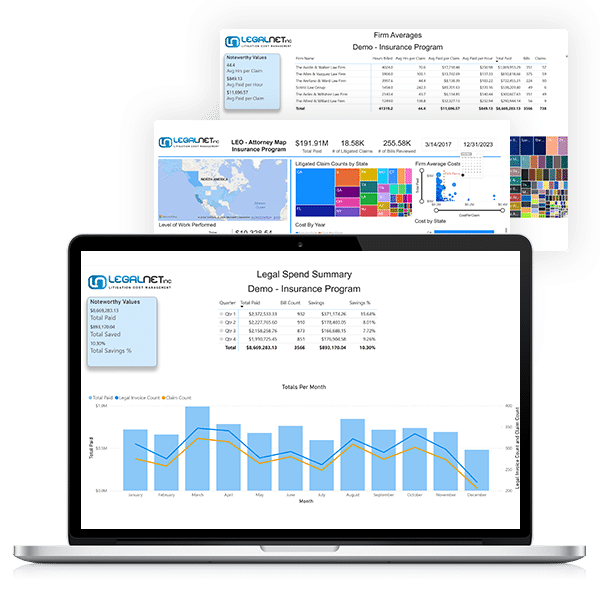

LegalNet legalnetinc.com has grown into one of the industry’s most trusted and respected brands for legal cost containment. They review legal bills for many Fortune 50 companies, including their very first restaurant industry client who’s still engaged. Since 1993 they’ve reviewed nearly 600,000 bills and saved over $24 million. Their bill challenge rate is less than 1% and they’ve helped firms improve their cash flow because they ensure the claims providers pay promptly, creating a win-win scenario. LegalNet reviews bills across all insurance lines with a centralized team of claims and legal experts.

The difference: claims and legal professionals who really understand how the litigation management process works. Their LEO Data Analytics dashboard is strategically customized to client specifications.

“Clients don’t pay us,” says Burkland. “We partner with their designated firms for a nominal bill review fee and guarantee them payment in 30 days. Our job is to hold firms accountable, get the right bill amount, but preserve all relationships.”

Burkland also feels there is enormous potential in litigation analytics, particularly medical bill review. Some score carding that may apply:

- Wins & Losses by line of coverage

- Case durations. How long to resolve litigated cases? For example, how many settle within 30 to 60 days of trial or hearing, or less?

- Compliance time with strategies and tactics

- Jurisdiction analysis. Aggregate outcomes by jurisdiction across all lines of insurance.

- Attorney budget vs. outcome

- Adjuster outcomes and individual attorney outcomes. For adjusters, how many litigated cases under their assignment are opened/closed in prescribed period? This factors into duration.

- Leakage. What are costs of delays, who’s driving delays, are the best resources being utilized?

If there’s a Call to Action it’s this:

Connect claims and legal

platforms in a meaningful

way, much like medical

cost control systems are

embedded with claims

provider technology.

The revolution continues and it’s a fight everyone can win. Lafayette won one revolution in the USA and two in France by the time he died in 1834 a national hero in both countries. It just takes commitment and dedication to a cause.

Chris Curl, President – CECGroup-LLC

For more information on how LegalNet can help your company with Litigation Cost Management & Data Analytics solutions for litigated claims, please contact Vice President of Sales, Roger Lee at [email protected] or 214-636-9226