by Chris Curl, President – CECGroup-LLC

I’ve been writing a lot about how to reduce legal spend in the 21st Century (see series regarding Litigation Management Revolution), but the actual no-brainer is to prevent litigation in the first place. Insurance claims-related litigation is a waste of time, resources, and money. Getting there is tougher.

After watching insurance litigation play out over 42 years, we’re still not doing the right things early in the life of a claim to make a difference. It’s still about fundamental blocking and tackling.

Litigation Prevention – The Insureds

- Show empathy (find a way to get in their shoes) with injured workers or customers who have a claim. There is NO reason to be combative or contrary.

- Be nice, be supportive. Take the information and report it. Then, let the professionals handle it. It’s not a supervisor or store manager’s job to make a compensability or liability determination.

- Show support without making any commitments, make sure the employee or customer knows that their claim will be reported and handled.

- I can’t tell you how many times claimants have told me that they felt no support or empathy in early accident stages which caused them to reach to an attorney for help.

Litigation Prevention – Claims Adjusters

- You must be empathetic, put yourself in the claimant’s shoes, gain their trust in your first interaction.

- Your job is to resolve the claim as fast as possible, for the fairest amount possible.

- If they don’t trust or like you, that won’t happen, and it opens doors to plaintiff attorneys who will do whatever it takes to get their business. And that’s how litigation begins.

- Then you start moving the needle South on costs. You’ve already lost.

- If you legitimately deny the claim fine, but even then, make sure you explain why, and with conviction respectfully supported by facts.

The bottom line is the claims adjuster who will not only investigate and hopefully resolve the claim fairly and early, but do it in a way that respects the claimant’s feelings and point of view.

Even when fraud is suspected or you deny the claim, stay professional and respectful. This is business. I’ve seen adjusters haggle over $100 that could resolve a case, only to send the claimant to an attorney and potential litigation. Make good business decisions.

Litigation Prevention is key to carrier, TPA, and ultimately their insured’s success. However, when the inevitable occurs, execute the litigation management cost controls I’ve been talking about. Choose your defense counsel wisely, don’t abdicate resolution of the claim or suit to them, and hold them accountable.

Top 3 Takeaways

- Adjusters must continue to manage the case: recommend and sign off on strategies for resolution.

- Push to resolve cases early – don’t wait until you’re at the courthouse unless all parties are convinced the case should be tried.

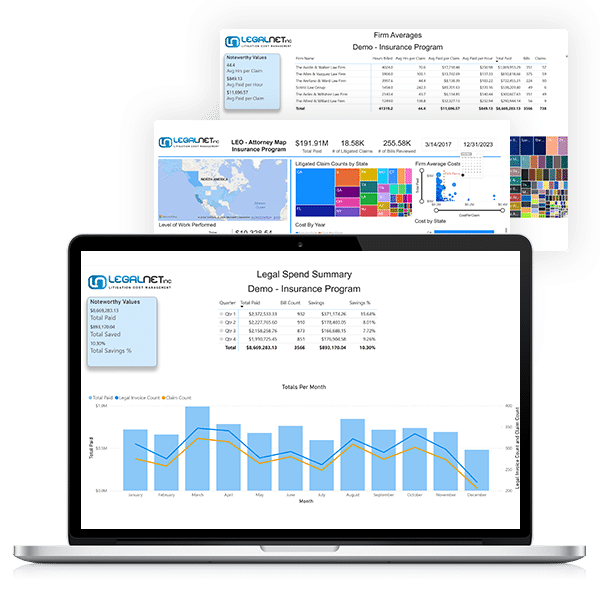

- Utilize firms like LegalNet to help you hold defense firms accountable. LegalNet understands defense costs and will help carriers, TPAs and self-insureds keep costs where they should be.

LegalNet provides state-of-the-art litigation management expense controls, but they also know that the best way to reduce those costs is to prevent litigation in the first place. So, play defense long before defense costs become an issue. Prevent litigation!

For more information on how LegalNet can help your company with Litigation Cost Management & Data Analytics solutions for litigated claims, please contact Vice President of Sales, Roger Lee at [email protected] or 214-636-9226.